Federal services disrupted and markets unsettled as U.S. enters fifth week of shutdown

U.S. Government Shutdown Becomes Longest in History, Markets React

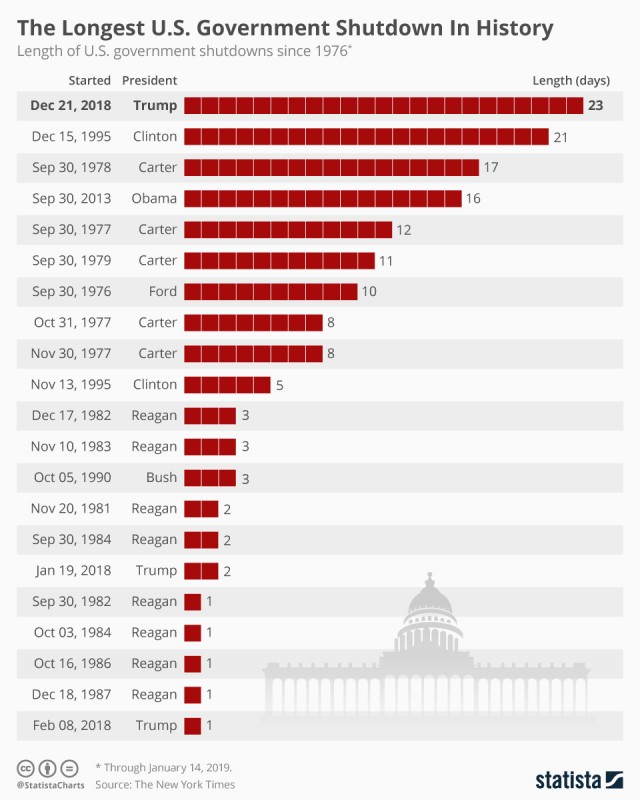

WASHINGTON — The United States federal government has entered its sixth week of a partial shutdown, marking the longest in the nation’s history. According to reports from Reuters and The Guardian, the impasse has paralyzed major public services, disrupted travel, and rattled financial markets, as political negotiations in Washington remain deadlocked (10/11/2025).

The shutdown triggered by a standoff over budget allocations for federal programs has left hundreds of thousands of federal employees furloughed or working without pay. “This is not just a political fight; it’s an economic crisis with real human costs,” said Senator Chuck Schumer, as quoted by The Associated Press (AP).

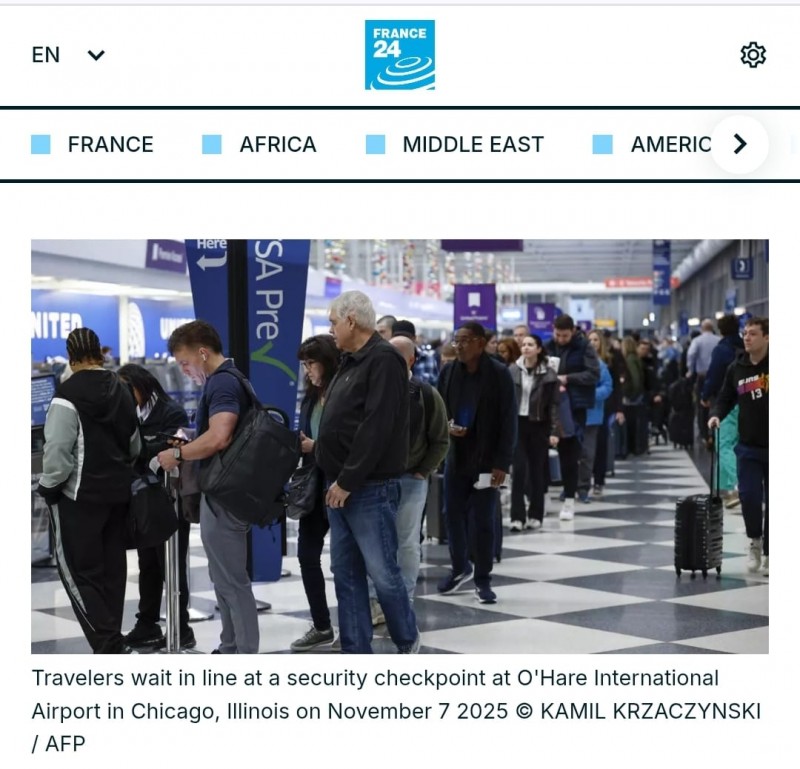

Critical government operations, including national parks, passport processing, and food safety inspections, have been partially suspended. The Federal Aviation Administration (FAA) confirmed that about 10% of domestic flights faced delays due to reduced staffing in air traffic control and security checkpoints.

According to The Guardian, airports in New York, Chicago, and Atlanta have reported long queues and cancellations amid rising traveler frustration.

Meanwhile, the U.S. Bureau of Economic Analysis (BEA) delayed the release of key economic indicators, limiting transparency in financial markets. Economists warn that the prolonged data blackout could undermine investor confidence and complicate decision-making for businesses and policymakers.

The shutdown’s economic toll is not confined to the U.S. The International Monetary Fund (IMF) warned in a statement that “a prolonged U.S. government shutdown could weaken global growth,” particularly through its impact on trade and consumer sentiment.

Asian markets reacted cautiously on Monday, with Japan’s Nikkei 225 and India’s Sensex rising modestly amid hopes that Washington would soon reach a deal. The Dow Jones Industrial Average, however, slipped 0.8% in early trading due to continued uncertainty.

“Global investors are watching closely,” said economist Sarah Johnson of Capital Economics, quoted by Reuters. “If the shutdown extends further, we could see a tightening in credit markets and weaker consumer spending across major economies.”

Negotiations between the White House and Congress have stalled over disputes in federal budget priorities. President Joe Biden urged lawmakers to approve a temporary spending bill, while Republican leaders insisted on deeper spending cuts before reopening government operations.

As the standoff continues, analysts warn of long-term damage to U.S. credibility and global financial stability. “Every additional week of paralysis adds billions in lost productivity and delays in critical programs,” said The Brookings Institution in its latest report.

For now, uncertainty remains the dominant sentiment in Washington and on Wall Street. Without a breakthrough soon, the record-setting shutdown risks reshaping both domestic politics and the global economic landscape.

Editor :Farros

Source : Reuters, The Guardian, Associated Press, IMF official statement on U.S. fiscal standoff